Being in business means facing a wide range of constant and ongoing risks. However, there are degrees of risk, from calculated to reckless. If you choose the latter path, you could be wagering with your company’s future. Taking calculated risks will lead to a better outcome for you and your brand.

Managing the risks you face involves carefully considering all the data you have access to. Given that 328.77 million terabytes of data are generated daily, that is a lot of information to sift through. Using data science in risk management can help you sort the wheat from the chaff and make informed decisions that present less risk to your organization.

What Is Risk Management?

There are three main elements to risk management in business. You identify the possible risks you face, assess how much of a risk those things pose, and then implement tactics to control or mitigate those risks.

Risks can come from varying sources, such as market risks and trends, technological developments, legal liabilities, and even political events. For example, when it comes to managing call operations, you may face risks from changes in regulatory requirements that require you to invest in new technology or extra training to ensure compliance.

A robust risk management policy is integral to the health of your business. Using data science in risk management should be a core part of any policy that gives you insights into the different risk scenarios you might face and the relationships between any risks and the different areas of your business they can affect.

What Is Data Science?

Therefore, you know how much data is generated daily and that it could be useful, but what do you do with it? Step forward data science. Data science combines analytical tools, AI, math, statistics, and, some would say, a sprinkling of art.

Put simply, data science takes all that information that may appear as nothing more than numbers and translates it into actionable insights that can inform your business decisions.

As you can probably guess, data science is a growing market, estimated to reach $378.7 billion by 2030. Using data science in risk management increases the chances of identifying and controlling any potential risks you may face.

The Different Stages of Data Science in Risk Management

To use data science in your risk management approach, you need to recognize the four main stages involved. Before you look at how you will use the data you collect, you should have an efficient data governance model in place. That gives you a foundation for how you use (and store) your data and can make any risk management work more accurate.

- Collection – Your data science lifecycle starts with how you collect your data. At this stage, the data could be structured or unstructured and can be collected from a variety of sources, such as your website or your sales team.

The method of collection can vary as well and can include manual entry, web scraping, and collecting data in real-time from systems and devices. The data you collect at this stage can also come in various forms, such as customer data (structured data) or video, audio, and log files (unstructured data). - Storage – The first thing to note is that some laws and regulations govern how you handle sensitive data. You also need different types of data storage since the data itself is in different formats at this stage. You will have a data management team of some sort, whose job is to set data storage standards and integrate with analytical workflows and ML (machine learning).

During the storage stage, your data will be cleaned, transformed, and combined. This is done using an extract, transform, load (ETL) or a similar data integration process. Once the data is prepared and the quality assured, it can then be transferred to a data warehouse or data lake. Also during this stage you will consider different architectural models such as medallion data architecture. - Risk analysis – This is the stage where data science kicks in. Your analysts will conduct exploratory work to identify patterns and ranges within your data sets. It is also the stage at which data scientists identify the relevance of the data being examined and how it can be used in different areas of modeling, such as ML or predictive analytics.

It is these models that are central to the use of data science in risk management. They will help you identify the potential risks, and how much of a problem they may pose, and can then lead to you identifying control or mitigation tactics. - Presentation – Certainly, data is almost like a foreign language at times, and your C-suite needs to see findings in a way they understand and can base decisions on. That means taking the relevant data, analyzing potential implications, and presenting it as written reports or in visualization form.

Many data scientists work in common programming languages such as Python or R, and these languages include the ability to generate visualization reports. They can also use dedicated tools that are designed purely for visualization.

What Are the Benefits of Using Data Science in Risk Management?

Utilizing data science as part of your risk management strategy provides several benefits.

1. Informed decision-making

You do not want to make important business decisions based on a whim. Just because you like a new product does not mean your customers will. Data science provides the information and data-driven insights you need to make informed decisions with lower risks. You can use a predictive model to identify growth potential and any risks that will come with your decisions.

2. Savings

If you make an uninformed decision, it could be high-risk and a costly mistake. Risks and mistakes can cost you a lot of money but data science means you can avoid such errors and mitigate unavoidable risk factors so that if things do go south, they will be less costly than if not mitigated.

3. Competitive edge

Evidently, you do not want to fall behind your competitors. If anything, you want to be ahead of them. Combining data science with your risk management policy can give you that edge. You can get the opportunity to choose lower-risk products and projects that are more likely to keep your customers happy and less likely to cause you potential losses.

4. Optimize your processes and systems

No matter what sector you operate in, you will have various systems and processes. Some of them will be specifically designed to manage every operational risk. Data science can give you analysis highlighting any issues and potential bottlenecks, allowing you to optimize them to be more efficient in the future.

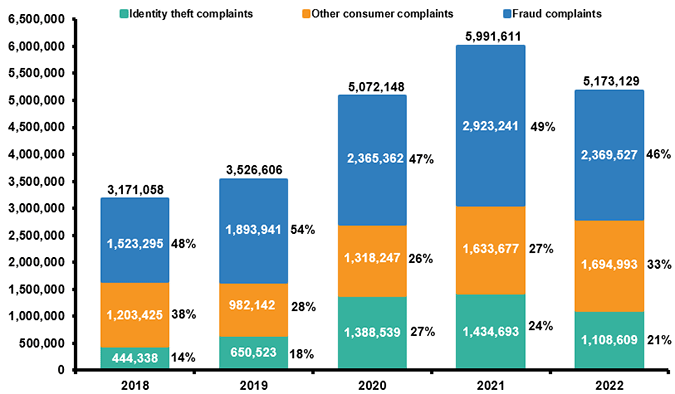

5. Fraud detection

Any business that deals in financial transactions or handles financial data faces the risk of fraud. Analytics in risk management practice means that you can identify potential ‘weak links’ in your cybersecurity management chain.

The result of in-depth risk analytics means you can implement more robust anti-fraud tactics at every stage. Data science can help track suspicious patterns (such as spending behavior) and flag anything that might be fraudulent activities.

6. Compliance

The amount of regulatory oversight you may have can vary greatly between sectors, but if you handle any sort of personal data, then you need to be sure you comply with relevant laws.

Using data science can identify gaps in your current compliance processes and reduce the risk of incurring regulatory violations and fines. You can also use data science and advanced analytics to monitor your ongoing compliance.

Five Tips for Implementing the Use of Data Science

Thus, you can see the benefits of data science in risk management and maybe even have tools ready, such as the Nvidia RAPIDS accelerator. How should you move forward?

- Business goals – While the common goal may be to reduce risk, this can look different for each organization. The first step should be identifying any specific risks you want to mitigate or eradicate. You should also inform your workforce about your use of data analytics and the risks you are targeting.

- Collect the data – When you know your goals, you can identify what data will be relevant to any analytical process. You will want all the data to be of high quality, and easily readable, and you should be able to categorize it according to different criteria such as source and format.

- Analyze – You should now have organized datasets relevant to any effective risk management process. Once the data is cleaned, you want to start analyzing it; this involves gaining insights, identifying key risk indicators, correlations, patterns, and assessing any risks.

- Act – Once you have completed any analytical tasks, you should have insights you can act on. You can act on these insights by making informed decisions, implementing risk mitigation strategies, or even tactics that can prevent particular risks from occurring.

- Repeat – The use of data science in risk management is not a one-off exercise. Future risks could be very different, so you want to implement risk monitoring and repeat the entire process regularly. Monitoring and new analyses can also help gauge previous tactics’ success.

Conclusion

Every business faces risk at some level. Taking steps to either eradicate or mitigate that risk can be crucial to the ongoing health of your organization. The data you collect from various sources is as valuable as oil and can help you make informed decisions based on the insights you gain from analytic processes.

Knowing how to use data science in risk management, reduces the potential of damage from any risks you face. It will bring several benefits, including saving money and making your risk management processes more efficient. With the amount of data being generated increasing daily, data science can provide results in various areas of your business, as well as risk management.